IDENTITY VERIFICATION (KYC)

Attract more customers, without the risk of fraud

Identify trustworthy users and block risky ones instantly

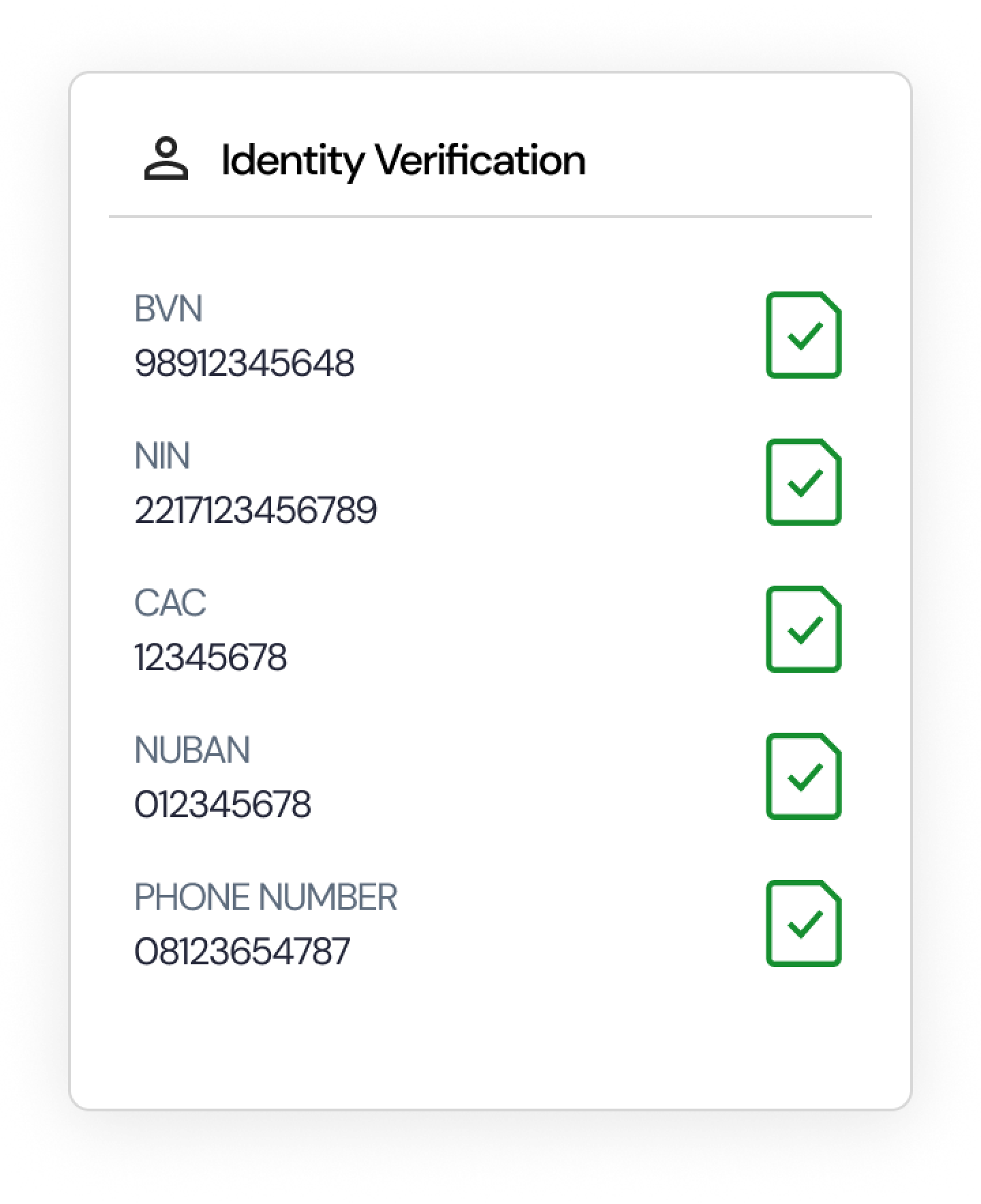

Confirm Identity data

Verify identity information against all government-approved databases in seconds

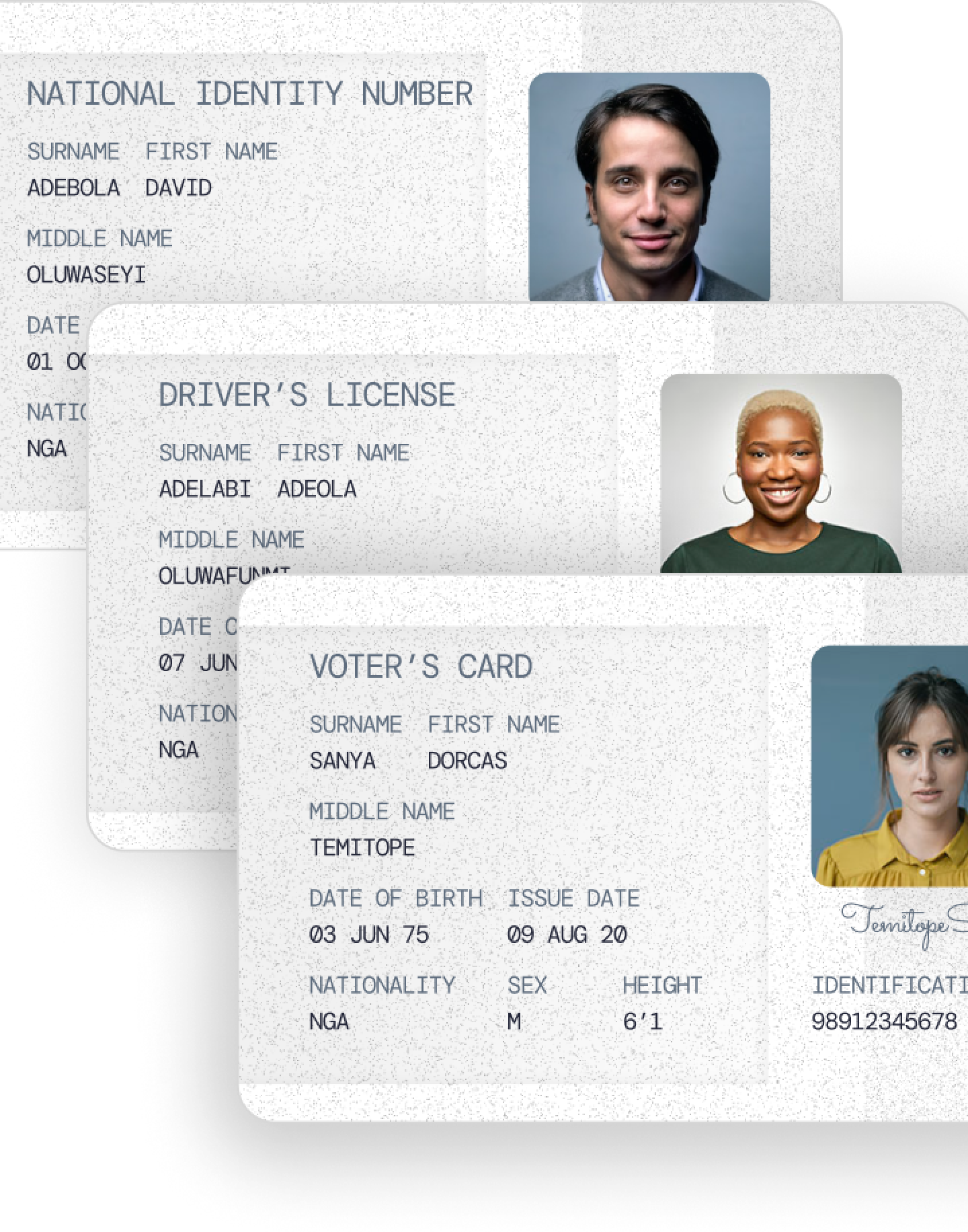

Verify ID Documents

Verify that government-approved ID documents are authentic and valid

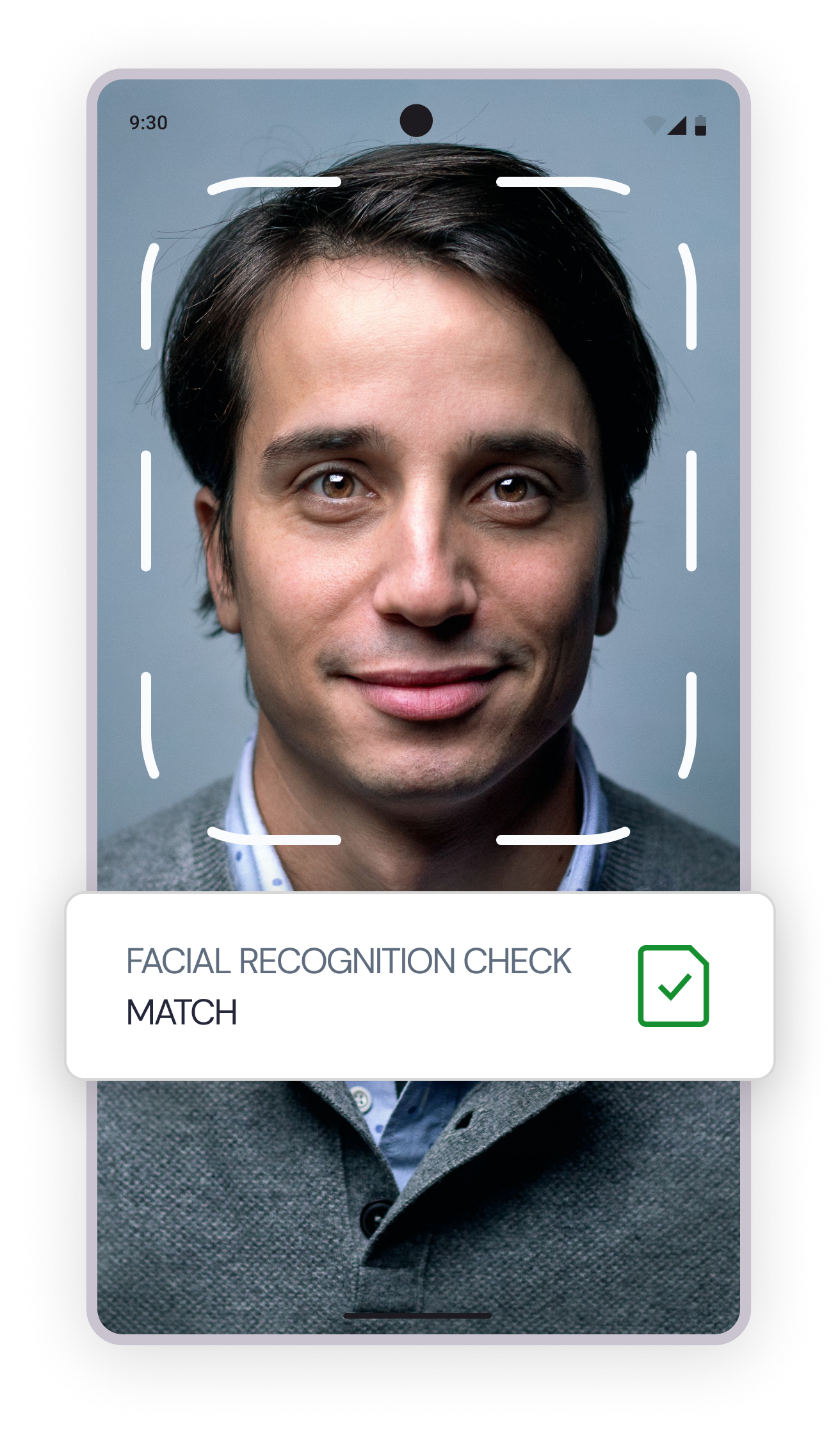

Confirm Liveness Check

Verify that the person’s face matches the photo on their provided ID

WITH Zeeh

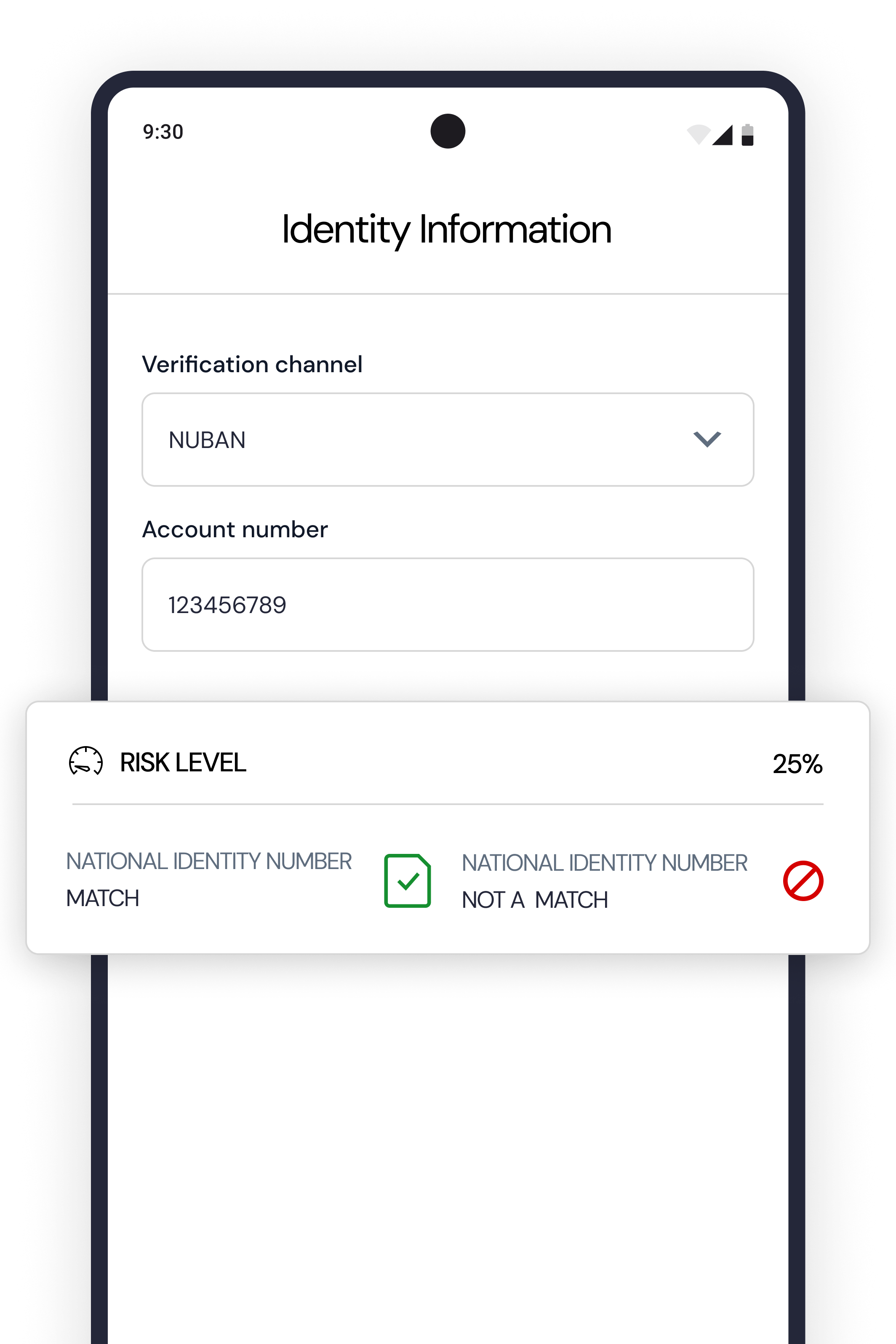

Safeguard your business against Fraud & risk

Prevent sophisticated attacks, identity fraud, and fake account signups with real-time identity verification. Our AI powered anti-fraud engine analyzes hundreds of risk signals to reduce fraud losses and protect your business

Loan Collections

Reduce the risk of bad loans by verifying borrower information through Account Number or BVN Lookup.

Fraud Prevention

Minimize identity fraud or fake account signups by verifying users' account and identity details in real-time

Business Verification

Instantly onboard businesses with smoother KYB flows by using CAC or TIN lookup to retrieve and verify accurate business information.

Financial Account Verification

Automate and secure account verification processes for users with endpoints like the 360view, Account Number, or BVN Lookup.

Enhanced Customer Onboarding

Implement Zeeh Identity Verification in your onboarding process to rapidly and reliably verify identity information, speeding up the registration and activation of new accounts.

80%+

Reduce Fraud Losses by Up to 80%

50%+

Onboard Customers 50% Faster

<24hrs

Seamless Integration in Less Than 24 Hours

Discover the power of Zeeh Identity Verification

View API Docs

Developer Friendly API

For Developers, By Developers

Providing a personalized experience for users through Interoperable and customizable Products that can work seamlessly, enabling smooth integration and data exchange.

1234567891011121314~~~~

Here's what some of them are saying.

Choosing a data infrastructure provider that delivers high-quality financial information without the need for programming or coding is crucial for us, that's why we use Zeeh.

David Adeleke

Co-Founder, Daxlinks

The transition and integration with Zeeh went smoothly. Furthermore, their customer service is exceptional, consistently ready to provide support.

Ini Jones

Developer, Zeeh

The process of collecting statements is the most efficient I've experienced thus far. The platform is highly secure, and I've never encountered any issues.

Tomi Akano

CEO, TomXcredit

Choosing a data infrastructure provider that delivers high-quality financial information without the need for programming or coding is crucial for us, that's why we use Zeeh.

David Adeleke

Co-Founder, Daxlinks

The transition and integration with Zeeh went smoothly. Furthermore, their customer service is exceptional, consistently ready to provide support.

Ini Jones

Developer, Zeeh

The process of collecting statements is the most efficient I've experienced thus far. The platform is highly secure, and I've never encountered any issues.

Tomi Akano

CEO, TomXcredit

Read up on some news about Zeeh

Featured in StartUs Insights' Top 10 Open Banking Companies

AIFinTECH100 Recognition: Zeeh was listed in the prestigious AIFinTECH100 for 2024...

AWS Fintech Accelerator: Zeeh was selected as a finalist in the AWS Fintech Accelerator Cohort...

In 2022, Zeeh was awarded the title of Fastest Growing Open Banking API Provider in Nigeria

Zeeh has received widespread media coverage for its contributions to financial inclusion in Africa...

How Zeeh is redefining access to credit in Africa through open banking - CNBC Africa

Revolutionizing Loan Recovery: Nigeria’s Zeeh Introduces GSI Technology-Based Solution

Zeeh launches GSI technology-based loan recovery solution to lower non-performing loan rates

Fintech can bridge the gap with open banking, says Zeeh CEO

Company

Zeeh

© All right reserved, Zeeh 2024